KtsClick Store

Neo Banking

Neo Banking refers to a new generation of banks that provide digital-only banking services,

Neo Banking

Key Features:

1. Mobile-first approach

2. Minimal to no physical branches

3. Digital onboarding and KYC

4. Real-time transactions and updates

5. Personalized financial services

6. Integration with fintech platforms

7. API-driven architecture

8. Data analytics for tailored offerings

Benefits:

1. Convenience and accessibility

2. Lower operational costs

3. Increased efficiency

4. Enhanced customer experience

5. Real-time transaction processing

6. Improved security and compliance

7. Scalability and flexibility

Types of Neo Banks:

1. Digital-only banks

2. Challenger banks

3. Fintech banks

4. Mobile-only banks

Ktsclick Smart Portal

KTSClick Smart Portal is an innovative platform designed for travel professionals, offering streamlined booking and management capabilities.

Ktsclick Smart Portal

Key Features:

1. User-friendly interface

2. Real-time inventory and pricing

3. Bookings for flights, hotels, packages, and more

4. Secure payment gateway

5. Automated booking confirmations

6. Customizable booking reports

7. Integration with GDS (Global Distribution Systems)

8. Mobile accessibility

Benefits:

1. Increased efficiency and productivity

2. Enhanced customer satisfaction

3. Improved revenue management

4. Access to diverse travel inventory

5. Simplified booking and payment processes

6. Real-time updates and notifications

7. Scalable and secure platform

.jpeg)

IRCTC E-Ticket Agency

CGS HOSPITALITY is Principle Agnets of IRCTC ,we are provide IRCTC E Ticket Agency thorugh CGS Hopitality

IRCTC E-Ticket Agency

via our Network Partner. With a strong focus on technical developed, Easier booking portal & User Friendly portal for our network partners, we offer personalized travel solutions, tailored to meet the unique needs and preferences of clients, we are principle agent of IRCTC & Company has provide rail e ticket agency to pan India, with the name of CGS hospitality based in Kolkata, company has started 2017 with small place bow we are having great strength of network & Transaction volume of Company ,we are planning to improved & good Quality of Services through this CGS Hospitality Portal.

Interesting ! You want to know about offering IRCTC e-ticket agency services. IRCTC (Indian Railway Catering and Tourism Corporation) is a popular platform for booking train tickets in India. To offer IRCTC e-ticket agency services, you'll need to become an authorized agent. Here's a brief overview of the process:

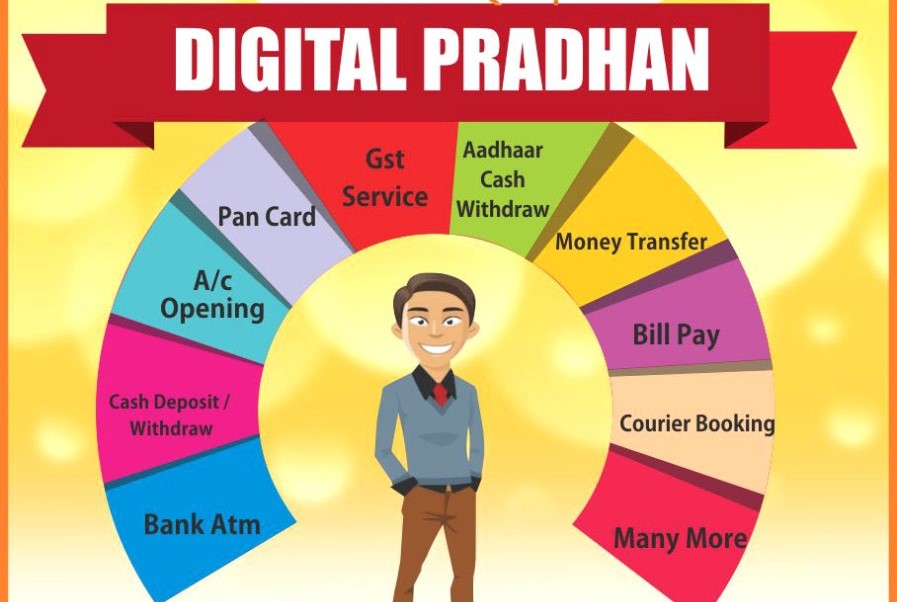

ktsclick Digital Pradhan

A bundle of all KTSClick services offered to franchisees at a discounted rate Designed to help franchisees generate more profits

ktsclick Digital Pradhan

Benefits of KDP Scheme:

- Increased profitability for franchisees

- Convenience of offering a single bundle of services to customers

- Competitive pricing for franchisees

- Opportunity for franchisees to upsell and cross-sell services to customers

- Support from KTSClick in marketing and promoting KDP services

Courier Franchise

Courier franchise is a business opportunity where an individual or entity partners .

Courier Franchise

Benefits of Courier Franchise:

1. Low initial investment

2. Potential for high returns

3. Flexibility and autonomy

4. Established brand reputation

5. Ongoing support and training

6. Access to a vast network

7. Job creation opportunities

Types of Courier Franchise:

1. Domestic courier franchise

2. International courier franchise

3. Express courier franchise

4. Logistics franchise

5. E-commerce logistics franchise

Popular Courier Franchise Options:

1. DTDC Courier & Cargo

2. Blue Dart Express

3. FedEx

4. UPS

5. DHL

6. Aramex

7. Ekart

8. Delhivery

Requirements for Courier Franchise:

1. Initial investment (varies by franchise)

2. Business space (office/warehouse)

3. Equipment (computers, printers, etc.)

4. Staff (depending on franchise requirements)

5. Valid licenses and permits

6. Vehicle(s) for delivery

Courier Franchise Models:

1. Single-unit franchise

2. Multi-unit franchise

3. Master franchise

4. Area developer

Key Considerations:

1. Market demand and competition

2. Franchise reputation and support

3. Investment and revenue potential

4. Operational requirements and logistics

5. Legal and regulatory compliance

Growth Prospects:

1. Increasing e-commerce demand

2. Growing need for fast and reliable delivery

3. Expansion into new markets and services

4. Adoption of technology for efficiency

Challenges:

1. Competition from established players

2. Regulatory compliance and licensing

3. Managing operational costs and logistics

4. Maintaining service quality and customer satisfaction

Pan card agency

Corporate PSA of UTI for Provide Pan Card Agency , enabling individuals and businesses to apply for Pan card .

Pan card agency

KTSClick Pan Card Agency Services:

1. New PAN application

2. PAN correction/reprint

3. Lost/damaged PAN replacement

4. PAN verification

Benefits of partnering with KTSClick:

1. Earn commission on each PAN application

2. Opportunity to offer additional services (e.g., Aadhaar, passport)

3. Access to KTSClick's technology platform

4. Dedicated support team

5. Marketing assistance

Requirements to become a KTSClick Pan Card Agency:

1. Valid business registration

2. Basic computer skills and internet connectivity

3. Dedicated workspace

4. Ability to promote KTSClick services

KTSClick Pan Card Agency Support:

1. Online training and tutorials

2. Dedicated support team

3. Marketing materials and assistance

4. Regular updates on PAN application status

E-Govern Seva

Provide E-Governance services, some of which are free, while others may require a nominal fee.

E-Govern Seva

Without Loyality with Free e-Governance Services:

1. Aadhaar Enrollment and Update

2. PAN Card Application and Correction

3. Passport Seva (Application and Tracking)

4. Voter ID Card Application and Correction

5. Ration Card Application and Correction

6. Driving License Application and Renewal

7. Vehicle Registration and Fitness Certificate

8. Birth and Death Certificate Application

9. Income Certificate Application

10. Caste Certificate Application

Benefits:

1. Convenience and accessibility

2. Time-saving and efficient

3. Reduced paperwork and documentation

4. Secure and reliable transactions

5. Access to various government services

KTSClick e-Governance Services Terms and Conditions:

1. Services are provided as per government portal availability.

2. No additional fees are charged for e-Governance services.

3. No loyalty or rewards are offered for these services.

4. No guarantee is provided for service delivery or outcomes.

Available e-Governance Services:

1. Aadhaar Enrollment and Update

2. PAN Card Application and Correction

3. Passport Seva (Application and Tracking)

4. Voter ID Card Application and Correction

5. Ration Card Application and Correction

6. Driving License Application and Renewal

7. Vehicle Registration and Fitness Certificate

8. Birth and Death Certificate Application

9. Income Certificate Application

10. Caste Certificate Application

Important Notes:

1. KTSClick acts as a facilitator, not a provider.

2. Services are subject to government portal availability and regulations.

3. Users must comply with government rules and regulations.

4. KTSClick is not responsible for service delays or rejections.

Disclaimer:

KTSClick disclaims any warranties, express or implied, regarding the e-Governance services. Users acknowledge and agree to the terms and conditions before availing the services.

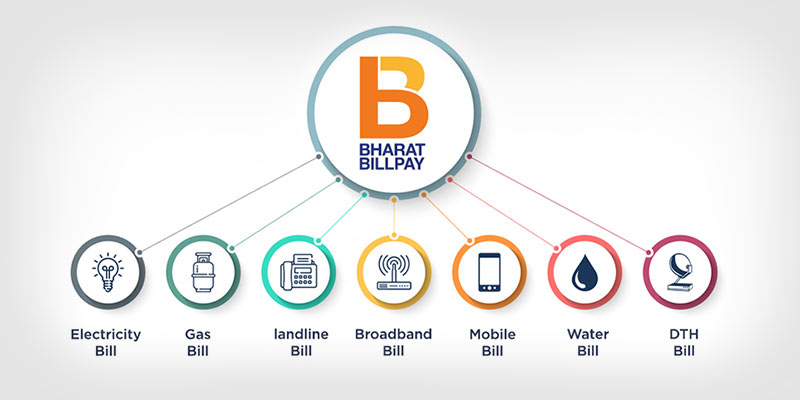

BBPS Utility Seva

Ktsclick Offering Utility services for pay bills across various categories with a secure & convenient .

BBPS Utility Seva

BBPS Services:

1. Electricity Bill Payment

2. Water Bill Payment

3. Gas Bill Payment

4. Telephone Bill Payment

5. Internet Bill Payment

6. DTH Recharge

7. Mobile Postpaid Bill Payment

8. Insurance Premium Payment

9. Loan Repayment

10. Credit Card Bill Payment

Biller Categories:

1. Electricity (18+ billers)

2. Water (10+ billers)

3. Gas (5+ billers)

4. Telecom (15+ billers)

5. DTH (6+ billers)

6. Insurance (10+ billers)

Key Features:

1. Secure and reliable transactions

2. Real-time payment confirmation

3. Multiple payment options (Credit/Debit Card, Net Banking, UPI)

4. Easy bill discovery and payment

5. Bill payment reminders

6. Transaction history

Benefits:

1. Convenience and time-saving

2. Reduced errors and disputes

3. Increased security and trust

4. Rewards and discounts on select bill payments

5. 24/7 customer support

How to Pay Bills:

1. Visit KTSClick website or mobile app

2. Select biller category and biller name

3. Enter customer ID and bill amount

4. Choose payment option and complete transaction

5. Receive payment confirmation and receipt

Certifications:

1. NPCI certified BBPS operator

2. PCI-DSS compliant

3. ISO 27001 certified

Note: Services and features may vary based on location and availability.

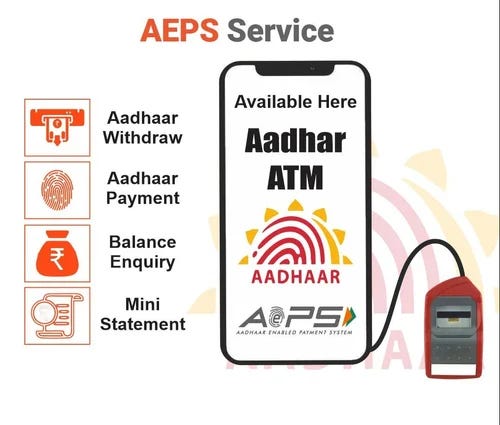

Mini ATM

KTSClick's Mini ATM device enables users to withdraw cash and perform various banking trans.

Mini ATM

Features:

1. Compact and portable design

2. Secure and reliable transactions

3. Supports multiple card types (Debit, Credit, Prepaid)

4. PIN-based authentication

5. Real-time transaction updates

6. Low transaction fees

Transaction Types:

1. Cash Withdrawal

2. Balance Inquiry

3. Mini Statement

Benefits:

1. Convenience and accessibility

2. Increased financial inclusion

3. Reduced ATM fees

4. Secure transactions

5. Real-time transaction updates

Requirements:

1. Valid merchant ID

2. Internet connectivity

3. Power source

4. Compatible card reader

Security Features:

1. PIN encryption

2. Secure socket layer (SSL) encryption

3. Tamper-evident seal

4. Real-time transaction monitoring

Certifications:

1. RBI approved

2. NPCI certified

3. PCI-DSS compliant

4. ISO 27001 certified

Note: Features, specifications, and fees may vary based on location and availability.

Domestic Money Transfer

KTSClick Domestic money transfer services, enabling users to send money to beneficiaries across India.

Domestic Money Transfer

Services:

1. Instant Money Transfer (IMT)

2. NEFT (National Electronic Funds Transfer)

3. RTGS (Real-Time Gross Settlement)

4. IMPS (Immediate Payment Service)

5. AePS (Aadhaar Enabled Payment System)

Features:

1. Secure and reliable transactions

2. Real-time transaction updates

3. Multiple payment options (Cash, Card, Net Banking)

4. Beneficiary management

5. Transaction history

Benefits:

1. Convenience and accessibility

2. Fast and secure transactions

3. Wide reach (across India)

4. Competitive exchange rates

5. 24/7 customer support

Partners:

1. Banks (HDFC, ICICI, SBI, etc.)

2. Payment aggregators (CCAvenue ,PayU, Paytm etc.)

3. Wallets (Paytm, ICICI , etc.)

Security Features:

1. SSL encryption

2. 2-Factor Authentication

3. PIN encryption

4. Real-time transaction monitoring

Certifications:

1. RBI approved

2. NPCI certified

3. PCI-DSS compliant

4. ISO 27001 certified

Note: Services, features, and charges may vary based on location and availability.

QR Code Standy

KTSClick's Dynamic QR Code enables merchants to accept digital payments securely and conveniently.

QR Code Standy

Overview:

KTSClick's Dynamic QR Code solution enables merchants to accept digital payments securely and conveniently. It supports multiple payment options, provides real-time transaction updates, and offers customizable QR code designs.

Key Features:

1. Dynamic QR code generation

2. Customizable QR code design

3. Multiple payment options (UPI, Cards, Wallets)

4. Transaction tracking and analytics

5. Real-time payment confirmation

6. Secure and convenient transactions

7. Reduced cash handling

8. Faster checkout process

Benefits:

1. Increased sales

2. Improved customer experience

3. Reduced transaction errors

4. Enhanced security

5. Real-time transaction updates

6. Simplified payment processing

7. Increased customer footfall

Merchant Onboarding:

1. Registration on KTSClick website

2. Verification of business documents

3. Activation of dynamic QR code

Security Features:

1. End-to-end encryption

2. Secure socket layer (SSL) encryption

3. Two-factor authentication

4. Real-time transaction monitoring

Certifications:

1. RBI approved

2. NPCI certified

3. PCI-DSS compliant

4. ISO 27001 certified

Documentation:

1. Merchant Agreement

2. Terms and Conditions

3. Privacy Policy

Payout Payment

KTSClick's Payout Solution enables businesses to make secure and efficient to individua, vendors,

Payout Payment

Overview:

KTSClick's Payout Solution enables businesses to make secure and efficient payments to individuals, vendors, or employees. The solution offers multiple payment modes, real-time tracking, and customizable reporting.

Features:

1. Multi-payment modes (IMPS, NEFT, RTGS, UPI)

2. Real-time payment tracking

3. Customizable reporting

4. Secure payment processing (SSL encryption)

5. API integration for seamless connectivity

6. Support for bulk payments

7. Automated payment reconciliation

8. Transaction history and audit trail

Benefits:

1. Faster payment processing

2. Reduced payment errors

3. Increased efficiency

4. Enhanced security

5. Improved cash flow management

6. Simplified reconciliation

7. Better vendor/employee relationships

Payout Solutions:

1. Employee Salary Payouts

2. Vendor Payments

3. Freelancer Payments

4. Refund Processing

5. Reward and Incentive Payments

6. Government Disbursements

7. Insurance Claims Payouts

Integration:

1. API integration

2. SDK integration

3. Webhook notifications

4. SFTP file transfer

Security:

1. SSL encryption

2. Two-factor authentication

3. PCI-DSS compliance

4. ISO 27001 certification

Documentation:

1. Merchant Agreement

2. Terms and Conditions

3. Privacy Policy

4. API Documentation

Certifications:

1. RBI approved

2. NPCI certified

3. PCI-DSS compliant

4. ISO 27001 certified

Ktsclick FinTech Portal

Fintech Portal is comprehensive platform offering various financial technology services to individuals, businesses,

Ktsclick FinTech Portal

Overview:

KTSClick Fintech Portal is a comprehensive platform offering various financial technology services to individuals, businesses, and merchants.

Services:

1. Payment Gateway

2. Domestic Money Transfer

3. Mini ATM Services

4. BBPS (Bharat Bill Payment System)

5. AePS (Aadhaar Enabled Payment System)

6. UPI (Unified Payments Interface)

7. Wallet Services

8. Payout Solutions

9. QR Code Payments

10. Insurance Services

Benefits:

1. Secure and reliable transactions

2. Convenient payment options

3. Real-time transaction updates

4. Increased financial inclusion

5. Reduced transaction costs

6. Enhanced customer experience

7. Simplified payment processing

Features:

1. User-friendly interface

2. Multi-language support

3. Customizable dashboard

4. Transaction tracking and analytics

5. Secure authentication and authorization

6. Integration with various banks and financial institutions

Target Audience:

1. Individuals

2. Businesses

3. Merchants

4. Financial Institutions

5. Government Agencies

Partnerships:

1. Banks (HDFC, ICICI,kodak etc.)

2. Payment aggregators (CCavenue , PayU, Paytm etc.)

3. Wallets (Paytm, ,ccAvenue etc.)

4. Insurance companies (LIC, HDFC Life, etc.)

Security:

1. SSL encryption

2. Two-factor authentication

3. PCI-DSS compliance

4. ISO 27001 certification

Certifications:

1. RBI approved

2. NPCI certified

3. PCI-DSS compliant

4. ISO 27001 certified

FAQs:

1. What services does KTSClick offer?

2. How secure is the platform?

3. What are the benefits of using KTSClick?

4. How to integrate with KTSClick?

5. What are the charges for various services?

Documents:

1. Terms and Conditions

2. Privacy Policy

3. Merchant Agreement

4. API Documentation

.jpeg)

GST Seva

GST services Franchise for New registeration ,Update GST Return Filling Etc..with take Offlile support form CA Consulatnt

GST Seva

KTSClick offers comprehensive GST services to businesses, enabling seamless compliance with India's GST regulations.

GST Services:

1. GST Registration

2. GST Return Filing (GSTR-1, GSTR-2, GSTR-3B)

3. GST Invoice Generation

4. GST Payment Processing

5. GST Reconciliation

6. GST Audit and Compliance

7. GST Consultancy

Benefits:

1. Accurate GST compliance

2. Timely return filing

3. Reduced penalties

4. Improved financial management

5. Enhanced business credibility

6. Simplified GST processes

Features:

1. Secure and reliable platform

2. Real-time GST updates

3. Automated GST calculations

4. Customizable GST reports

5. Multi-user access

GST Registration:

1. New registration

2. Migration from existing tax regimes

3. Amendment of registration

GST Return Filing:

1. GSTR-1 (sales return)

2. GSTR-2 (purchase return)

3. GSTR-3B (summary return)

4. GSTR-4 (composition scheme return)

5. GSTR-9 (annual return)

GST Invoice Generation:

1. Customizable invoice templates

2. Auto-generation of invoices

3. Invoice uploading and storage

GST Payment Processing:

1. Online payment gateway

2. GST payment processing

3. Payment reconciliation

GST Reconciliation:

1. Automatic reconciliation

2. Manual reconciliation

3. Reconciliation reports

GST Audit and Compliance:

1. GST audit and review

2. Compliance checks

3. Rectification of errors

GST Consultancy:

1. GST advisory services

2. GST planning and strategy

3. GST training and support

Documentation:

1. GST registration certificate

2. GST return filing acknowledgement

3. GST invoice copies

4. GST payment receipts

5. GST reconciliation reports

KTSClick Finance Hero

Financial services are a broad term that describes the various products, technologies, and services that help people

KTSClick Finance Hero

Financial services include a wide range of activities, such as banking, insurance, investment services, and digital banking technology. They allow people and businesses to borrow, save, spend, and invest money

Mini ATM Pocket

A mini ATM device is a compact, portable, and user friendly device that enables users to perform various financial transactions

Mini ATM Pocket

Overview:

A mini ATM device is a compact, portable, and user friendly device that enables users to perform various financial transactions, such as cash withdrawals, balance inquiries, and fund transfers.

Features:

1. Compact size and lightweight

2. Touchscreen interface

3. Secure PIN entry

4. Contactless card reader

5. Thermal printer for receipt printing

6. GPRS ,3G ,4G connectivity

7. Battery powered rechargeable

Transactions:

1. Cash withdrawal

2. Balance inquiry

3. Fund transfer

4. Mobile recharge

5. Bill payment

6. Mini statement

7. PIN change

Benefits:

1. Convenience

2. Portability

3. Easy to use

4. Secure transactions

5. Real time transactions

6. Reduced queues at traditional ATMs

7. Increased financial inclusion

Types:

1. Android based mini ATMs

2. Linux based mini ATMs

3. Windows based mini ATMs

4. Cloud based mini ATMs

Security:

1. SSL encryption

2. Secure PIN entry

3. Contactless card reader

4. Tamper proof design

5. Regular software updates

Specifications:

1. Display: upto 7 inches touchscreen

2. Processor: Quad core Dual core

3. RAM: upto 2 GB

4. Storage: upto 8 GB

5. Battery: upto 4000 mAh

6. Connectivity: GPRS 3G 4G Wi Fi, Bluetooth

Certifications:

1. RBI approval

2. PCI DSS compliance

3. EMV certification

4. ISO 27001 certification

Applications:

1. Banking

2. Financial inclusion

3. Rural banking

4. Microfinance

5. E commerce

6. Retail

Mini ATM Device Providers:

1. KTSClick

2. Paynear

3. Mswipe

4. Ezetap

5. Ingenico

Pricing:

1. Device cost: Upto 15,0000

2. Transaction fees: upto 2%

3. Monthly rental fees: upto 2,000

Amazon Easy Store

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English. Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).